Potential pricing regimes for a global low-carbon hydrogen market

According to the International Energy Agency’s (IEA) net zero by 2050 roadmap, hydrogen will play a crucial role in the transition to net zero emissions by decarbonizing sectors that are difficult or uneconomical to electrify. The wide-scale adoption of hydrogen across these sectors will have to overcome numerous technical and economic hurdles ranging from production to end-use. Many countries will likely need to import hydrogen to satisfy local demand and will need to create development standards, certification schemes, and marketplaces to support an effective and transparent hydrogen trade.

The creation of a new global market for hydrogen begs a simple question: what pricing mechanism will best reflect the value of hydrogen as a critical decarbonization molecule?

Unfortunately, the existing hydrogen market doesn’t provide us with many clues. In 2020, global hydrogen demand stood at 90 million tonnes per year (MTPA) according to the IEA. Current demand is mostly dedicated to refining and heavy industry including the production of fertilizers and chemicals. Most of this hydrogen already being produced is captive; whereby hydrogen is produced and consumed on-site. As a result, hydrogen pricing is very localized and determined based on confidential long-term supply agreements between two parties. Projected hydrogen trends suggest that this localized model won’t be relevant for the bulk of hydrogen demand in 2050 or beyond.

Hydrogen Demand by Sector, 2000 – 2020

The IEA estimates that the global hydrogen demand will reach 530 MTPA by 2050, driven by an increase in use of hydrogen across many sectors including heavy duty transportation and industrial heating, among others. Since highly industrialized and resource-poor nations cannot generate all their low-carbon hydrogen demand, hydrogen will no longer necessarily be confined to a localized consumption pattern but will need to be transported across international borders much like natural gas today. The International Renewable Energy Agency estimates that, by 2050, a quarter of global hydrogen demand will be internationally traded, a scenario that draws parallels to today’s gas market where 33% of gas demand crosses borders.

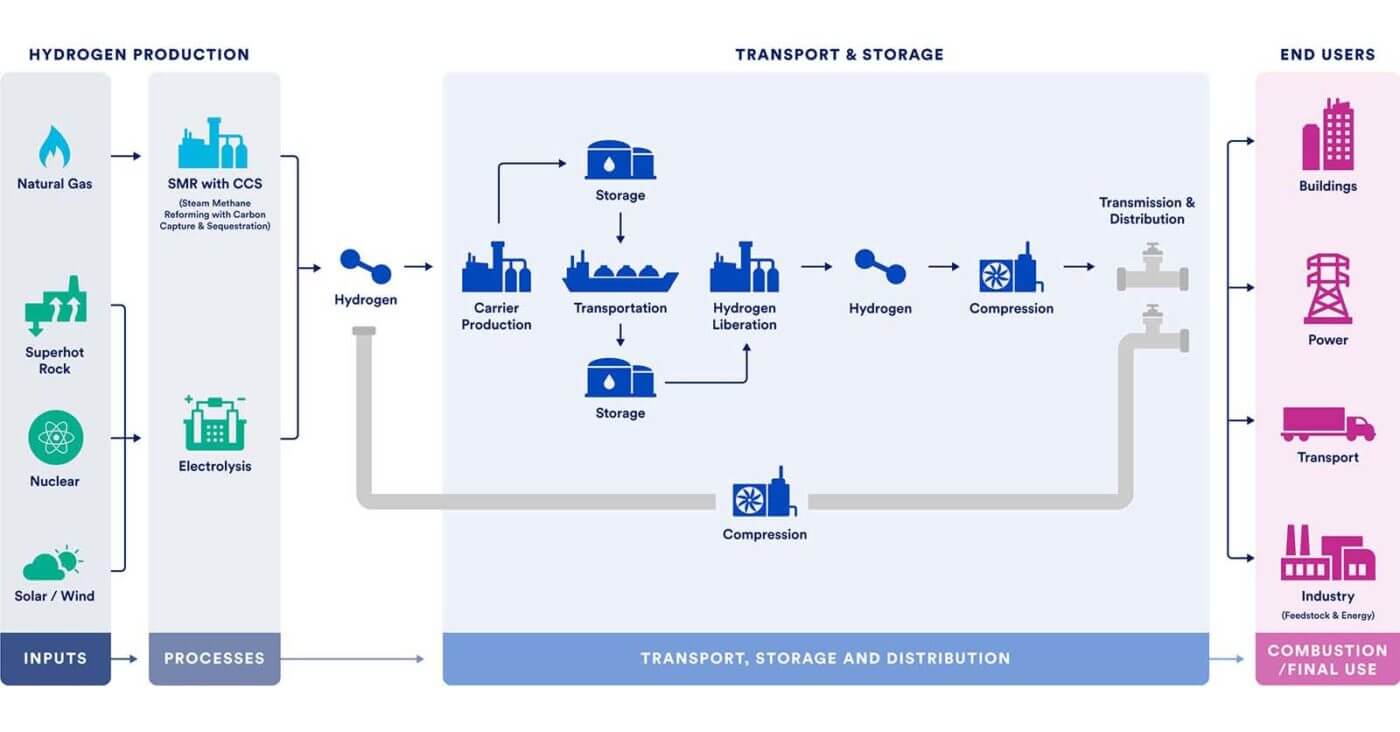

Unlike natural gas, hydrogen is significantly more difficult to transport over large distances whether by pipeline or by maritime transport. Due to hydrogen’s physical and chemical properties, liquefying hydrogen at -253 degrees Celsius to transport it by ship is much more challenging compared to liquified natural gas (LNG), which is stored and shipped at -162 degrees Celsius. As such, so-called ‘hydrogen carriers’ such as ammonia and liquid organic hydrogen carriers (LOHCs) are seen as potential enablers of hydrogen maritime trade. However, these carriers require an elaborate network of infrastructure, chemical conversion processes, and technology solutions to transport the hydrogen molecules as shown in the figure below.

Transporting hydrogen by pipelines is more straightforward as it circumvents the need for carriers or for cryogenic operations. However, transporting hydrogen by pipelines requires approximately three times the power needed to transport an equivalent amount of energy in the form of natural gas and can be associated with higher capital expenditures.

The complexity of the hydrogen transportation supply chain highlighted is an important feature for any international hydrogen trade and has direct implications on pricing frameworks. Specifically, pricing variances between exporting and importing regions are expected to be significant to account for the intermediate steps required to store, export, transport, and import the hydrogen. The fuel itself is just one part of a large and complex value chain.

It’s worth remembering that traditional commodity markets like oil or gas have taken decades to develop. As the hydrogen trade increases in scale, technology matures and transportation costs decrease, the outline of a hydrogen market and an associated pricing mechanism will develop to facilitate the emerging trade.

What is hydrogen’s intrinsic value?

Nations with comparatively lower costs of hydrogen production do not necessarily sell at lower prices to consumers but command larger profit margins; as is the case in global commodity trade, where commodity prices are set by supply and demand, albeit via an elaborate financial structure and pricing mechanisms on global exchanges such as the New York Mercantile Exchange. Financial services around oil and gas enable an effective pricing mechanism that supports price discovery. Does hydrogen have the potential to transform into a globally traded commodity such as oil, where physical cargoes are traded many times over and where financial instruments such as futures, swaps, derivatives, and other options have emerged? Would regional hydrogen benchmarks be used to price the hydrogen delivered? This may be premature for any hydrogen trade and pricing strategy but can nonetheless serve as a guide as markets develop.

Pricing mechanisms translate market fundamentals into price levels. The supply and demand landscape for low-carbon hydrogen is still nascent, and hydrogen pricing will likely not follow a benchmark or spot price to begin with. Nonetheless, certain attempts are being made to create hydrogen exchanges such as ‘HyXchange’ in the Netherlands which aims to assist in the price discovery process. In the meantime, hydrogen pricing will likely be determined using an alternate pricing mechanism determined between two parties. The three pricing mechanisms below—value-based, net-back, and import parity—serve as potential options to be considered when assigning a price for globally traded low-carbon hydrogen.

- Value-based pricing – This pricing framework is far removed from the world of commodities and is generally used for merchandise in the consumer retail business where perceived value grants companies pricing power. In a nascent low-carbon hydrogen market, the hydrogen would be priced depending on the value that low-carbon hydrogen would provide compared to the alternative, considered to be unabated fossil hydrogen for this exercise. In this price setting mechanism, the value provided is linked to the CO2 emissions avoided and equal to the carbon taxes saved by switching to low-carbon hydrogen. For instance, for low-carbon hydrogen production via the steam reforming of methane coupled with carbon capture at a 93% rate and 1.5% upstream methane emissions, the emissions savings over a 20-year GWP time frame are estimated to be 7.7kg CO2e /kg H2 compared to the same process with no carbon capture and storage. Assuming a carbon price of $100 per ton of CO2, then the premium or value of this specific low-carbon hydrogen would be $0.77 per kg over the price of unabated hydrogen. Some challenges with this pricing model include:

- The absence of a hydrogen spot or reference price to which this premium is applied

- The lack of an internationally recognized and comprehensive hydrogen certification scheme that facilitates assigning carbon credentials to the hydrogen being traded

- The low-carbon premium that potentially falls short of covering the additional costs associated with low-carbon hydrogen production much less its transportation costs it if is to be imported

- A smaller CO2e/kg H2 differential for imported hydrogen (due to the supply chain emissions from additional hydrogen transport) that implies a lower price target for imported low-carbon hydrogen

- Net-back pricing – This pricing mechanism is widely used for oil and oil products and is a proxy for the operational efficiency of these producers. Under this mechanism, the price of hydrogen in the exporting country would be set equal to that in the importing country minus cost of production, transportation, insurance, and tariffs. This pricing mechanism might be viable if the cost of production of hydrogen in exporting countries is significantly less than that of importing countries. Otherwise, this pricing mechanism would be a sure way for the producing nation to be selling low-carbon hydrogen at a loss. Based on the hydrogen trade agreements being signed over the past few years, it seems that countries such as Oman, the UAE, Saudi Arabia, and Australia are front-runners for low-carbon hydrogen exports with the largest importers being Germany, Netherlands, and Japan. Given this list, one can expect a clear advantage in production costs for exporting nations over the importing nations. Some factors that influence the cost of production for low-carbon hydrogen are:

- Competitively priced natural gas in resource-rich countries that have not liberalized the energy market prices and provide subsidized natural gas to the domestic industry. Natural gas typically accounts for 80-85% of the operating expenses for a Steam Methane Reformer (SMR)+carbon capture and storage hydrogen production facility, and operating expenses typically account for two-thirds of the cost of production of so-called ‘blue’ hydrogen. As such, producing countries with access to cheap feedstock can produce hydrogen at much lower costs.

- Competitive Power Purchase Agreements (PPA) from renewable projects that can significantly undercut PPA prices in the importing markets. These low rates are achieved by providing market incentives for renewable energy developers such as free land leases and reduced network access fees and transmission costs. Electricity is the main operating expense for electrolytic hydrogen and is a strong determinant of the cost of production.

- Renewable resource quality that influences renewable capacity factors and electrolyzer utilization thereby reducing the capital amortization component for ‘green’ hydrogen

- Access to cheap capital which in turn lowers the Weighted Average Cost of Capital (WACC) for the project and the overall cost of the hydrogen project

- Low capital investment for projects due to availability of capital, local supply chains and domestic experience with large energy and infrastructure developments

However, like the value-based pricing mechanism, the absence of a transparent and highly traded hydrogen market means that a reference for this pricing mechanism is a challenge.

- Import Parity Pricing – The hydrogen price at the border of the importing country is set equal to the price in the exporting country plus the cost of delivery, insurance, and tariffs. This price setting mechanism is typical for a market that is short on a commodity and is importing this commodity from another market. In the case of hydrogen, the price in the exporting country is likely to be determined on a marginal cost basis. Given the limited quantities of low-carbon hydrogen and the technical, financial, and business hurdles associated with bringing low-carbon hydrogen to destination markets, this pricing mechanism can be adopted under long-term supply agreements. It would provide the developers and investors a safety margin for return on their investment and would help to catalyze the supply of low-carbon hydrogen. A challenge with using marginal cost basis as a reference for any pricing is the set of incentives provided to the industry in the exporting nation. Incentives will help catalyze the growth of low-carbon hydrogen production but ultimately will not result in price-setting on the international market and will not be passed on to consuming nations. For instance, subsidies provided by governments in resource-rich countries help sustain the energy export industry whose products trade at international market prices. As such, any low-carbon hydrogen pricing adopted under this mechanism will exclude the financial effects of incentives provided.

- Other options – As ammonia is an effective hydrogen carrier, low-carbon hydrogen pricing could also be linked to ammonia prices which currently set the upper bound for regional hydrogen prices. However, liberating the hydrogen from ammonia means that the cost for the yet-to-be commercialized ammonia cracking process will need to be incorporated into the pricing regime. As such, the delivered low-carbon hydrogen will be priced higher than the ammonia it is derived from. Finally, low-carbon hydrogen pricing in the early stages will be heavily influenced by natural gas and electricity prices. Despite the increasing penetration of renewables into the grid, electricity and gas prices are still highly correlated in the absence of renewable power islands dedicated for hydrogen production. As such, low-carbon hydrogen pricing can also be linked to that of electricity or natural gas benchmarks.

An underappreciated barrier to hydrogen rollout

A low-carbon hydrogen market and associated pricing mechanisms will develop once a global-scale international hydrogen trade is established. However, this trade will need to meet many criteria to be technically and commercially viable and will likely start off with volumes dedicated to single end users. As such, a nascent hydrogen trade will mostly be governed by long-term supply contracts between two parties and pricing mechanisms for low-carbon hydrogen will likely be determined on a case-by-case basis with similar characteristics to that of today’s localized captive hydrogen market. The challenge, of course, will be to negotiate a price for a ‘new’ commodity in the absence of traditional price discovery facilitators.

At the center of CATF’s efforts to accelerate the scale-up of low-carbon hydrogen production is assisting with the creation of a global climate beneficial hydrogen market. This blog explored the potential pricing regimes for low-carbon hydrogen in the early stages of a developing market which is likely to be fragmented and not dominated by a few players. In case a dominant supplier of low-carbon hydrogen emerges, the price of low-carbon hydrogen will largely be influenced by cost inputs and margins set by the dominant supplier. CATF is working with stakeholders across the United States, the Middle East, and Europe to shape the defining features of a global hydrogen market.