From Act to action: How the Inflation Reduction Act is accelerating decarbonization in the United States with carbon capture and storage

This blog is the first in a series that will examine the Inflation Reduction Act’s wide-ranging impacts on carbon capture, starting with a breakdown of project announcements to date and the state of play in the United States.

After the passage of the Inflation Reduction Act (IRA), there is significant new momentum to combat the climate challenge and meet our emissions targets by installing critically needed carbon capture and storage technologies. The dedicated spending and expanded tax credits in IRA have given developers even more reason to focus on capturing carbon pollution from air emissions waste streams and permanently storing it underground.

Just one year after passage, we’re already seeing this happen. Almost 40% of the current projects that are in the development pipeline were announced after the passage of the IRA, and the majority of these projects involve permanent storage. Storage resource development is crucial to the viability of carbon capture and the reduction and removal of CO2 on a large scale.

The provisions in IRA complement the bipartisan Infrastructure Investments and Jobs Act of 2021 (IIJA). Together, these legislative efforts increased funding for carbon management projects and infrastructure, especially transportation and geologic storage in saline aquifers.

One year later: Key takeaways

Out of the 50+ projects that have been announced since the passage of IRA, we’ve identified the following themes:

- Projects are becoming more widespread and innovative: Applications for carbon capture and storage projects are increasingly diverse and technologically advanced.

- Carbon storage takes center-stage: There is growing investment in and attention on the build-out of storage resources.

- Focus turns to industrial decarbonization: More projects are being announced in hard-to-abate industrial subsectors such as cement and steel as the 45Q tax incentives enhance project economics.

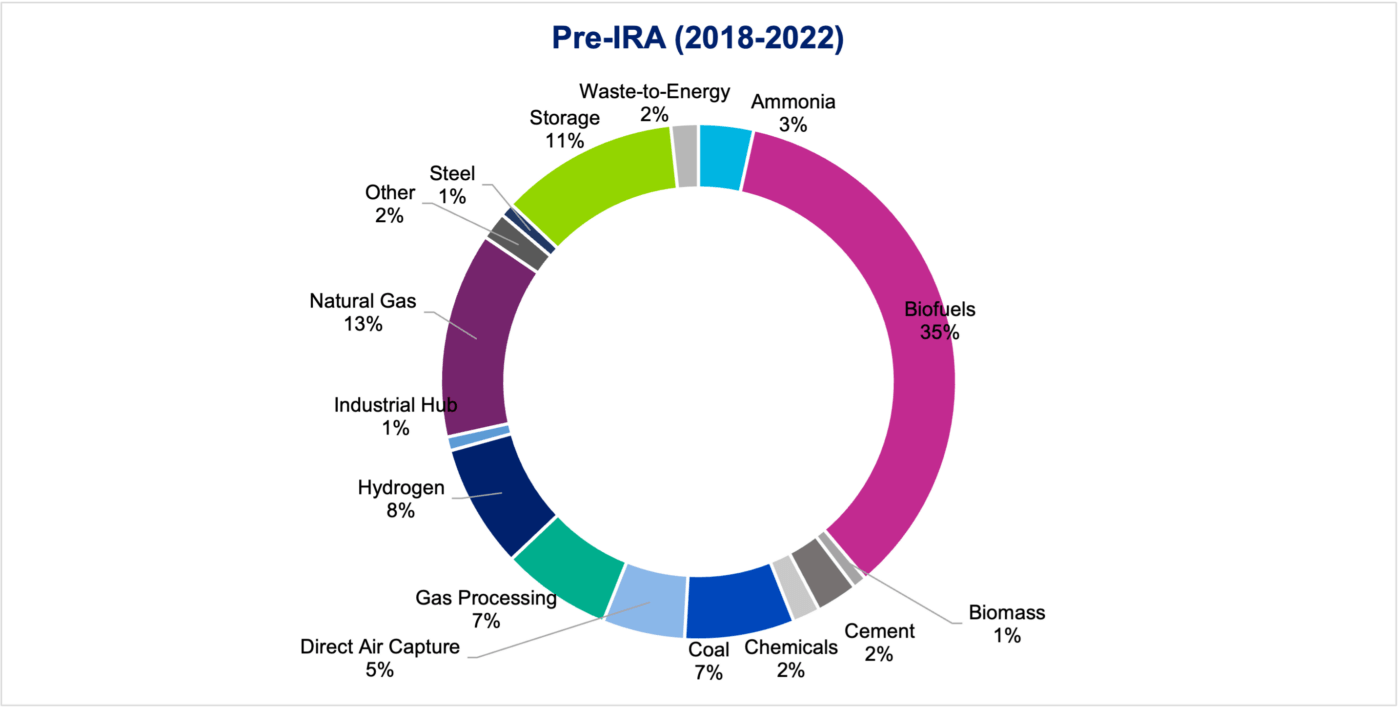

Integrated capture and storage project development is booming in the United States

Over 50 new capture, storage, and integrated capture and permanent storage projects have been announced between the passage of IRA in August 2022, to July 2023, surpassing the 39 project announcements in the entirety of 2022. Even more importantly, the range of industrial applications for projects is more diverse, indicating that carbon capture and storage technologies are increasingly attractive for broader industrial decarbonization. While pre-IRA projects were primarily focused on ethanol plants, the suite of recent project announcements will control carbon pollution from sources in the ammonia, steel, and cement industries. Projects that capture carbon directly from ambient air, known as direct air capture or DAC, have also increased. CATF will publish forthcoming content on DAC and DAC hub advancement in the U.S.

In addition to projects dedicated solely to storage development, about 50% of the post-IRA announced capture projects are integrated capture and permanent storage projects, which is likely the result of added incentives to dedicated geologic storage under the revision of 45Q. The remainder of capture projects have not announced or committed to a storage classification, so we can expect that percentage to increase over time as these projects advance.

The U.S. carbon capture industry continues to lead

Projects that were announced prior to the IRA continue to make progress alongside ongoing technology development, securing U.S. leadership in carbon capture and storage. Various carbon capture projects have emerged over the past year that seek to prove higher capture rates, including advanced capture techniques or the use of new carbon capture methods and technologies both for point source capture and DAC. One example is Chart Industries cryogenic carbon capture technology at Central Plains Cement Company LLC’s cement plant in Sugar Creek, Missouri. Chart purports the ability to capture carbon at lower cost than conventional capture methods and eliminate co-pollutants like the SO2 and NOX along with the CO2 in the flue stream. In 2023, Chart Industries signed MOUs with Wolf Carbon Solutions and Koch Engineered Solutions to scale up their proprietary capture technology even further.

Progress in existing projects include the Marquis Industrial Complex, which announced it has commenced detailed engineering for one of the largest bio-energy carbon capture and storage projects in Illinois. More recently, Project Tundra, a power sector project led by Minnkota Power Cooperative in North Dakota, has moved to its final stage of development, including securing a round of financing.

These projects, along with technological and cost-savings innovation from the likes of national labs like Pacific Northwest National Lab (PNNL), are real-world examples of advancements in carbon capture leading to projects on the ground actively cutting carbon pollution from the point sources.

With the right incentives, carbon capture and storage projects and hubs are rapidly advancing

There has been a strong wave of project announcements dedicated specifically to storage development since the passage of IRA, representing nearly half of the total announced projects. These geologic storage announcements are notable because access to storage resources will determine the scalability of carbon capture.

Developers have initiated several storage hub projects over the past year, such as the Sweetwater Carbon Storage Hub in southwestern Wyoming, a project that is expected to permanently store over 350 million metric tons of CO2 in geologic reservoirs. In addition to private sector projects, the Sweetwater hub will be among the first multipurpose, open-source hubs in North America, providing carbon management to industrial emitters across the Mountain West in 45,000 acres of southwestern Wyoming. In May 2023, the DOE’s CarbonSAFE initiative awarded funding for storage validation and development to nine projects across Texas, Colorado, Georgia, North Dakota, Wyoming, and Illinois.

There are currently nearly 100 pending Class VI well permit applications for injection and storage with EPA, compared to the seven Class IV wells that are already permitted. This is a massive potential increase in storage resources to support the capture build-out.

Project announcements cluster around storage potential

Carbon capture projects have emerged across the country, from the greater Midwest, Great Plains, West, and increasingly the Gulf Coast, where the concentration of industrial activity and carbon-based energy production make the region prime for carbon management interventions. Much of the Gulf Coast is in close proximity to ideal CO2 storage resources and is home to extant CO2 infrastructure. The ongoing development of these areas with desirable storage resources highlights the need for robust community engagement processes and win-win project development for all CCS projects to ensure long-term operational success and maximum social benefit.

Hard-to-abate industrial projects moving forward

Carbon capture and storage is also gaining momentum in hard-to-decarbonize sectors, a promising sign for the broader policy objective of industrial decarbonization. At least two CCS projects have been announced in the steel industry in 2023, including a joint project by U.S. Steel and CarbonFree to study a carbon capture retrofit in the Gary Works integrated mill in Indiana and a Nucor-Exxon project in Convent, Louisiana. In the cement industry, two projects were recently awarded DOE funds for front-end engineering and design (FEED) studies: the CEMEX Balcones plant in New Braunfels, Texas and Mitchell Cement Plant in Mitchell, Indiana. Successful deployment of multiple industrial CCS projects is critical, as each successful project will help lower the costs for subsequent projects, allowing widespread adoption of carbon capture and storage technology, and associated rapid reductions in climate pollution from existing industrial sources.

Progress continues, but challenges remain

In total, announced projects in the pipeline present the opportunity to capture and store between 70-95 million tons of carbon annually, the equivalent of about 20 million passenger vehicles. The next several years will be pivotal in realizing the potential that carbon capture and storage offer as a climate solution.

As we build out pipeline transportation and storage infrastructure, new projects can be added to existing networks, cutting costs significantly and activating localized CCS clusters. Translating announcements into real projects will require regulatory and stakeholder support as well as favorable economics.

Many of these projects are a long way from their final investment decisions, and face continued challenges from policy and regulatory bottlenecks, slow infrastructure development, and broader social licensing. The forthcoming blogs will highlight some of these considerations and opportunities — as well as explore the IRA’s impacts on international carbon capture advancement — for further enabling carbon capture and storage projects in order to reach our collective decarbonization goals.